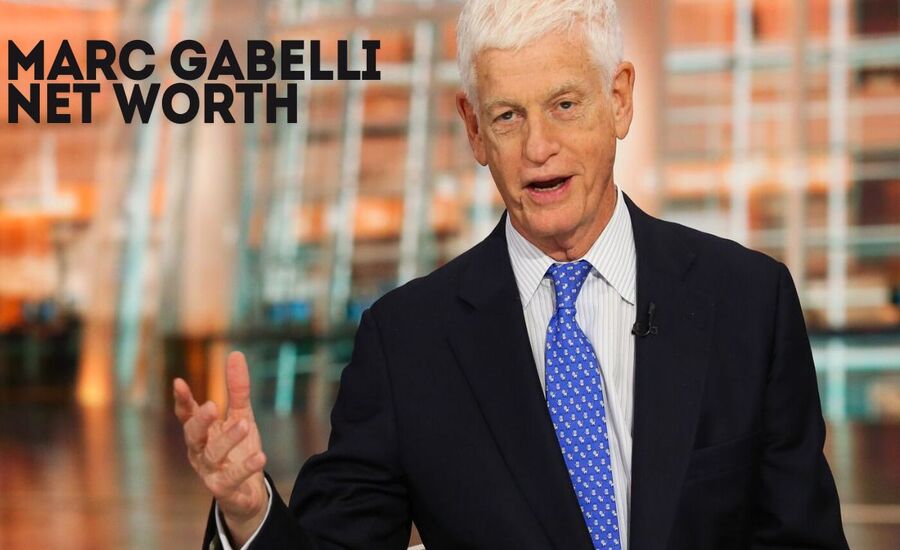

Marc Gabelli is a name synonymous with wealth, success, and an illustrious career in the world of finance. As the son of the legendary value investor Mario Gabelli, Marc had a foundation laid out for him that provided insights into the intricate workings of financial markets from an early age. However, his net worth and success today are not just the result of inheritance. Instead, it stems from a meticulously crafted career built on expertise, strategic decision-making, and an entrepreneurial spirit. Analyzing Marc Gabelli’s net worth entails a deep dive into his career, his business ventures, his investment philosophy, and how his approach to finance has set him apart in the industry.

Early Life and Background: The Influence of Family and Education

Marc Gabelli’s upbringing played a crucial role in shaping the path he would take in life. Born into a family steeped in investment wisdom, Marc had access to knowledge, resources, and a network that many aspiring financiers could only dream of. His father, Mario Gabelli, founded Gabelli Asset Management Company Investors (GAMCO), one of the largest investment firms specializing in value investing. This environment instilled a strong sense of financial acumen in Marc from a young age, giving him exposure to the complexities of investment strategies and portfolio management.

Marc Gabelli’s educational journey also set the foundation for his future success. He holds a degree from the Massachusetts Institute of Technology (MIT), which is known for producing leaders in business, technology, and science. Additionally, Marc earned an MBA from Columbia Business School, one of the most prestigious business schools in the world. This combination of elite education and family influence not only sharpened his intellectual abilities but also equipped him with the technical skills necessary for a prosperous career in finance. Furthermore, his education helped him cultivate a disciplined approach to investing, focusing on long-term value creation rather than short-term gains.

Marc’s ability to apply both theoretical knowledge and practical experience gained from his father’s firm enabled him to craft his investment strategies and build his empire. His approach is a reflection of the timeless principles of value investing, but with his own modern twist that adapts to changing market conditions. In addition to learning from his father, Marc developed a unique investment philosophy that blended risk management with growth potential, ensuring that his ventures were both lucrative and sustainable.

The Rise of GAMCO and Marc Gabelli’s Role in the Firm

Marc Gabelli’s association with GAMCO is one of the pivotal elements that contributed to his substantial net worth. GAMCO, under Mario Gabelli’s leadership, grew to become one of the leading investment management firms in the United States, managing billions of dollars in assets. Marc, being a key player in the firm, did not just ride the coattails of his father’s success; instead, he actively contributed to the growth and expansion of the business.

As the firm’s co-chairman and portfolio manager, Marc oversaw significant investment decisions, playing a critical role in the company’s asset management strategies. His deep understanding of the markets allowed him to identify undervalued assets and capitalize on opportunities that others often overlooked. This ability to pinpoint potential winners in the financial markets is what set Marc apart from other investors and solidified his reputation as a savvy financier.

GAMCO’s core philosophy of value investing revolves around the identification of companies that are trading below their intrinsic value. Marc, following this approach, helped the firm make investments in companies that had solid fundamentals but were temporarily undervalued by the market. This long-term perspective allowed GAMCO to reap significant rewards, and Marc’s role in executing these strategies further added to his growing wealth.

Marc Gabelli’s approach to portfolio management also emphasized diversification. He understood that while value investing was the core philosophy, spreading risk across different sectors and asset classes was essential for long-term success. This strategy helped shield GAMCO’s portfolios from extreme market volatility and ensured that the firm maintained steady returns even during challenging economic periods.

Marc Gabelli’s Entrepreneurial Ventures and Expanding Horizons

While Marc Gabelli’s association with GAMCO significantly contributed to his net worth, his entrepreneurial spirit led him to venture beyond the family business. Marc realized early on that to truly expand his wealth and influence, he needed to diversify his investments and take advantage of opportunities in various industries. His entrepreneurial ventures have played a key role in building his fortune, as they provided him with additional income streams beyond traditional investment management.

One of Marc’s most notable ventures outside of GAMCO was his involvement in the private equity space. As an astute businessman, he recognized the potential of private equity as a vehicle for wealth creation. Through his private equity firm, Marc invested in companies across various industries, including technology, healthcare, and consumer goods. His ability to identify companies with high growth potential and execute leveraged buyouts allowed him to significantly increase his wealth. Moreover, his experience in managing public companies gave him a unique advantage in restructuring and turning around distressed companies, further enhancing the profitability of his investments.

In addition to private equity, Marc Gabelli also expanded his interests into the energy and infrastructure sectors. He understood the importance of these industries in the global economy and positioned himself to capitalize on the growing demand for energy and infrastructure development. His investments in energy companies, particularly those focused on renewable energy, demonstrated his foresight and ability to adapt to the evolving economic landscape. As the world moves towards sustainable energy solutions, Marc’s investments in this space have paid off handsomely, contributing significantly to his net worth.

Philanthropy and Social Responsibility: A Balanced Approach to Wealth

Marc Gabelli’s success is not just measured by his financial accomplishments but also by his commitment to giving back to society. Like many high-net-worth individuals, Marc understands the importance of philanthropy and social responsibility. His approach to wealth is balanced by his desire to make a positive impact on the world, and this is evident through his involvement in various charitable initiatives.

Throughout his career, Marc has been an advocate for education, healthcare, and the arts. He has supported numerous philanthropic causes, donating significant sums to organizations that focus on improving access to quality education and healthcare services. His commitment to these causes reflects his belief that wealth should be used as a tool for positive change, rather than simply a means of personal gain. Marc’s philanthropic efforts have not only helped improve the lives of countless individuals but have also solidified his reputation as a socially responsible businessman.

In addition to his financial contributions, Marc has also taken an active role in promoting environmental sustainability. His investments in renewable energy and environmentally friendly technologies are part of his broader commitment to preserving the planet for future generations. Marc’s ability to align his business interests with his philanthropic goals has allowed him to create a lasting legacy that extends beyond financial success.

Key Components of Marc Gabelli’s Investment Philosophy

- Value Investing: Marc Gabelli’s investment philosophy is rooted in the principles of value investing, a strategy popularized by his father, Mario Gabelli. Value investing involves identifying stocks that are undervalued by the market but have strong fundamentals. Marc has refined this approach by incorporating modern investment tools and techniques to identify opportunities in various industries.

- Diversification: Marc understands the importance of diversification in managing risk and maximizing returns. His investment portfolio spans various sectors, including energy, technology, healthcare, and consumer goods. This diversified approach has allowed him to mitigate risk while capturing growth opportunities across different markets.

- Long-Term Perspective: One of the key factors contributing to Marc’s success is his long-term perspective on investing. Rather than chasing short-term gains, Marc focuses on building sustainable wealth over time. His ability to remain patient and disciplined in his investment decisions has paid off in the form of consistent, long-term returns.

Navigating Market Volatility and Economic Uncertainty

The global financial markets are constantly evolving, and with that comes periods of volatility and uncertainty. Marc Gabelli has demonstrated an exceptional ability to navigate these challenging times and come out ahead. His experience in managing large portfolios during periods of economic turmoil, such as the 2008 financial crisis and the recent global pandemic, has strengthened his reputation as a resilient investor.

During periods of market turbulence, Marc employs a strategy that focuses on capital preservation while seeking out opportunities to acquire assets at discounted prices. He views market downturns as buying opportunities, adhering to the adage that “the best time to buy is when there is blood in the streets.” This contrarian approach has allowed Marc to capitalize on undervalued assets and position himself for significant gains when markets recover.

Moreover, Marc’s emphasis on risk management has been a key factor in his ability to weather economic storms. He understands that managing risk is just as important as seeking returns, and he employs various hedging strategies to protect his portfolio from extreme market fluctuations. This disciplined approach has enabled Marc to maintain stability in his investments while still achieving impressive growth over the long term.

The Legacy of Marc Gabelli: Building a Lasting Empire

Marc Gabelli’s net worth is a reflection of his dedication, expertise, and entrepreneurial spirit. While his father’s influence and the success of GAMCO provided a solid foundation, Marc’s ability to expand his horizons and pursue new ventures has been instrumental in building his fortune. His unique blend of value investing, diversification, and strategic risk management has allowed him to consistently grow his wealth, even in the face of economic challenges.

However, Marc’s success goes beyond financial achievements. His commitment to philanthropy, environmental sustainability, and social responsibility underscores his belief that wealth should be used to create positive change in the world. Through his investments in renewable energy, his support for education and healthcare, and his philanthropic endeavors, Marc has made a lasting impact on both the business world and society at large.

Looking forward, Marc Gabelli’s legacy will continue to inspire future generations of investors and entrepreneurs. His career serves as a testament to the power of knowledge, discipline, and a long-term perspective in achieving success. As the world of finance continues to evolve, Marc’s influence will remain a guiding force for those who seek to navigate the complexities of the global markets and build lasting wealth.

Conclusion:

Marc Gabelli’s net worth is the culmination of decades of hard work, strategic thinking, and a relentless pursuit of success. His journey, shaped by the influence of his father, his education, and his own entrepreneurial ventures, offers valuable insights into what it takes to build and sustain wealth in today’s complex financial landscape. By adhering to the principles of value investing, embracing diversification, and maintaining a long-term perspective, Marc has not only built a substantial fortune but also created a legacy that extends far beyond his personal wealth.

As investors and entrepreneurs look to emulate Marc’s success, they would do well to study his approach to risk management, his ability to adapt to changing market conditions, and his commitment to making a positive impact on the world. The secrets to Marc Gabelli’s net worth lie not in a single strategy or investment but in the holistic approach he has taken throughout his career—a blend of intelligence, perseverance, and a deep understanding of the markets.

FAQs:

Marc Gabelli is an American businessman and investor, best known for his leadership roles at GAMCO Investors, an investment management firm founded by his father, Mario Gabelli. He is also a successful entrepreneur and philanthropist, with investments in private equity, energy, infrastructure, and other industries.

Marc Gabelli built his wealth through a combination of working within the family business, GAMCO Investors, and pursuing his own ventures in private equity, energy, and other sectors. His investment philosophy revolves around value investing, risk management, and diversification. He has been actively involved in identifying and managing undervalued assets, which contributed significantly to his fortune.

Marc Gabelli follows the principles of value investing, where he identifies companies trading below their intrinsic value. He emphasizes diversification across sectors such as energy, healthcare, technology, and consumer goods. His approach includes a long-term perspective, focusing on sustainable wealth growth rather than short-term gains.

GAMCO Investors played a foundational role in Marc’s career. As co-chairman and portfolio manager, Marc was instrumental in executing investment strategies that helped the firm grow its assets. His deep understanding of value investing and portfolio management greatly contributed to the company’s success and his personal wealth.

Marc Gabelli’s investment portfolio is diverse, spanning sectors such as energy (including renewable energy), healthcare, technology, and consumer goods. He has also been active in private equity, making investments in companies across various industries.